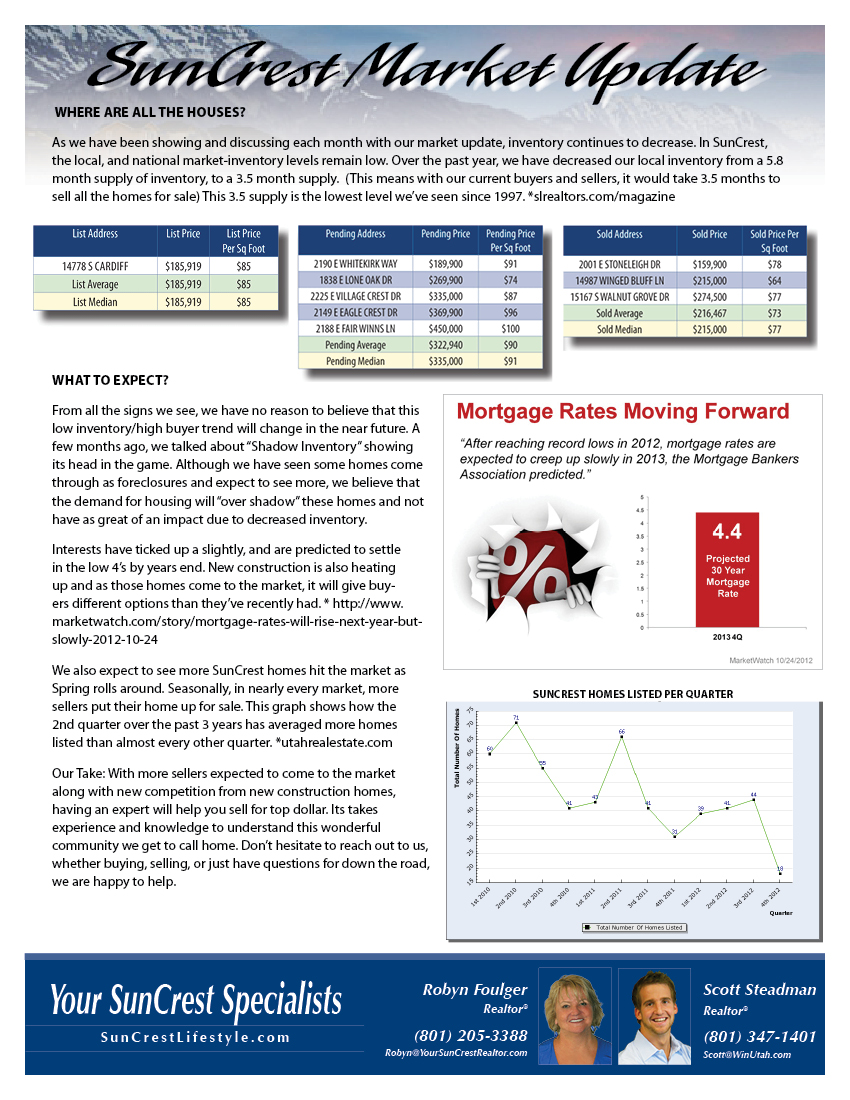

The 3.5% down payment on FHA loans could be more expensive for buyers than expected. Beginning April 1, 2013, the mortgage insurance premium will go up by .1% to 1.35% which may not even be noticeable to most would-be homeowners.

The staggering increase will occur on 6/3/2013 when FHA’s policy on the duration of the required mortgage insurance will be increased for the life of the mortgage. It basically doubles the amount of total MIP if the loan is paid to term.

(Regarding the current MIP duration: When the unpaid balance reaches 78% LTV of original purchase, the MIP can be released. In any event though, the minimum time must be five years.)

Currently, the MIP is required for approximately 9 years 9 months with normal amortization. The new program would require the MIP for the life of the loan. In this example, the initial monthly MIP is $196.88 which decreases based on amortization.

There are buyers that qualify on income and credit who may not have the necessary additional down payment required for 80% and 90% conventional loans. The 3.5% FHA program has provided a great vehicle to get into a home with a minimum amount of cash.

For homeowners that expect to stay in their home for ten years or less, the new changes might not have much financial impact. Homeowners who expect to be in their home long term can refinance with a conventional loan without mortgage insurance once the equity has increased due to amortization and appreciation.

For buyers to avoid these increases, they will need to act now to get the FHA commitment issued prior to these change dates.

Source: http://www.kcmblog.com/2013/02/19/fha-more-expensive-than-expected/

(more…)

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link