Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

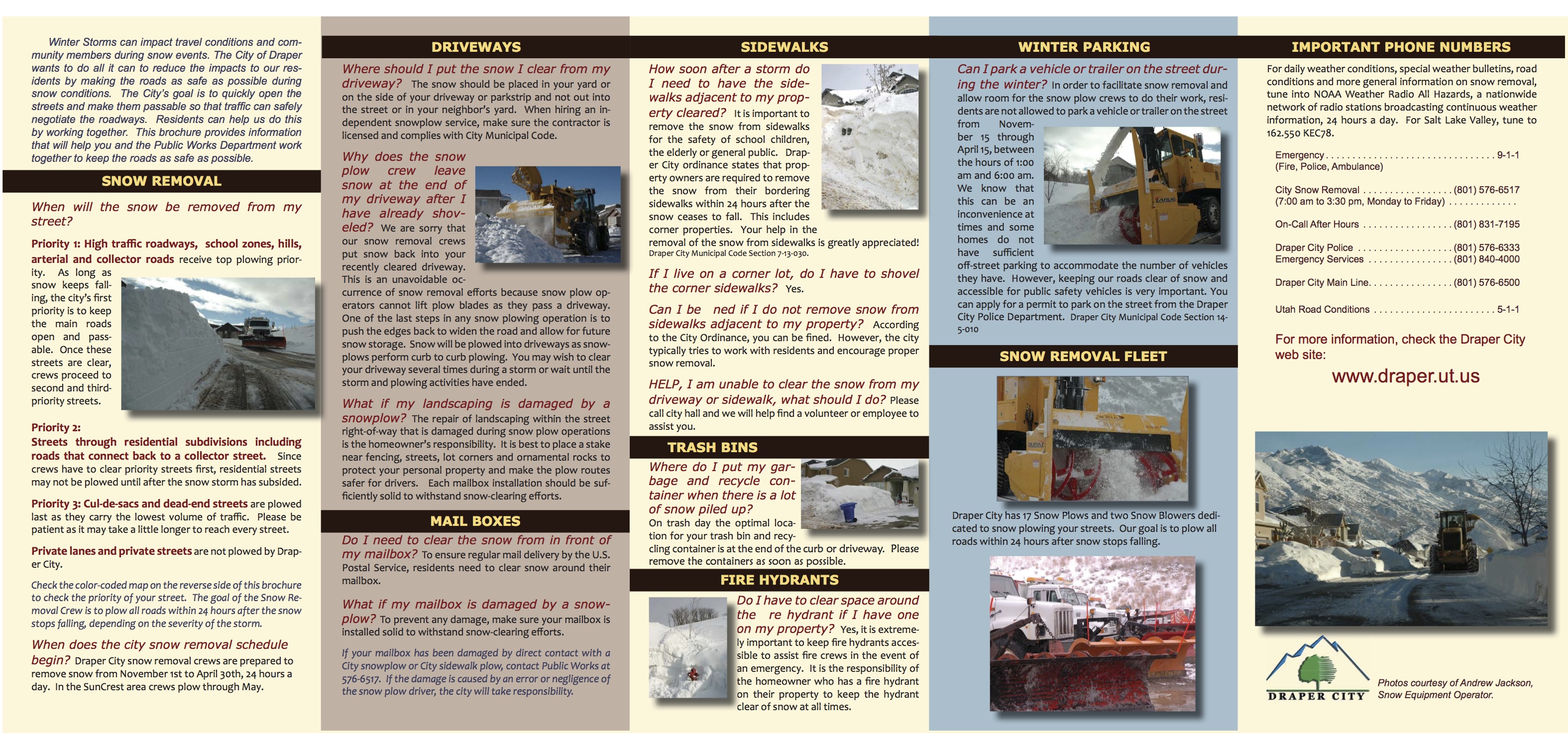

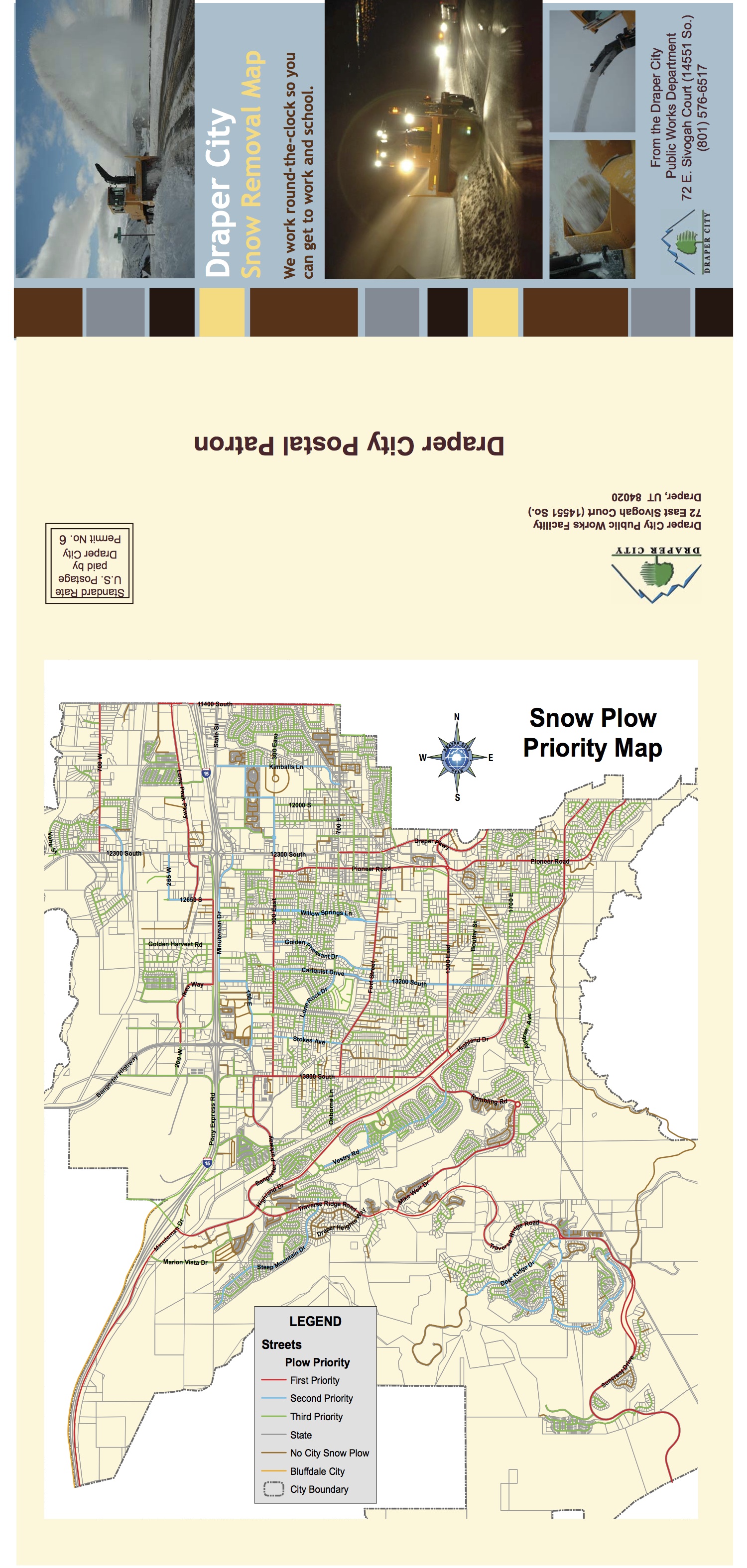

SunCrest (Draper City) Snow Removal Info

|

Click on the image to enlarge

Big Changes to FHA Loans

Where are mortgage rates headed?

This is one of the most common questions folks ask me. Where are rates going? What will happen after the election? What will happen after the holidays? What will happen next year? Should I wait to see if they go lower? Should I buy now before the go higher?

Below is a fantastic article I'd like to share with you folks.

The best people we can go to on this issue are the people who deal with it on a daily basis –The Mortgage Bankers Association (MBA). Here is what was reported by MarketWatch in a recent article:

“After reaching record lows in 2012, mortgage rates are expected to creep up slowly in the year ahead, the Mortgage Bankers Association predicted.

“After reaching record lows in 2012, mortgage rates are expected to creep up slowly in the year ahead, the Mortgage Bankers Association predicted.

Rates on the 30-year fixed-rate mortgage are expected to average 3.8% in the fourth quarter of 2012, rising to 3.9% in the first quarter of 2013 and eventually rising to an average 4.4% by the fourth quarter of next year.”

If the MBA is correct, mortgage interest rates could inch up almost a full percentage point in the next year. Tomorrow, we will explain what that means to a potential buyer.

http://www.kcmblog.com/2012/11/06/where-are-mortgage-rates-headed-2/

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link