Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

Big Changes to FHA Loans

Where are mortgage rates headed?

This is one of the most common questions folks ask me. Where are rates going? What will happen after the election? What will happen after the holidays? What will happen next year? Should I wait to see if they go lower? Should I buy now before the go higher?

Below is a fantastic article I'd like to share with you folks.

The best people we can go to on this issue are the people who deal with it on a daily basis –The Mortgage Bankers Association (MBA). Here is what was reported by MarketWatch in a recent article:

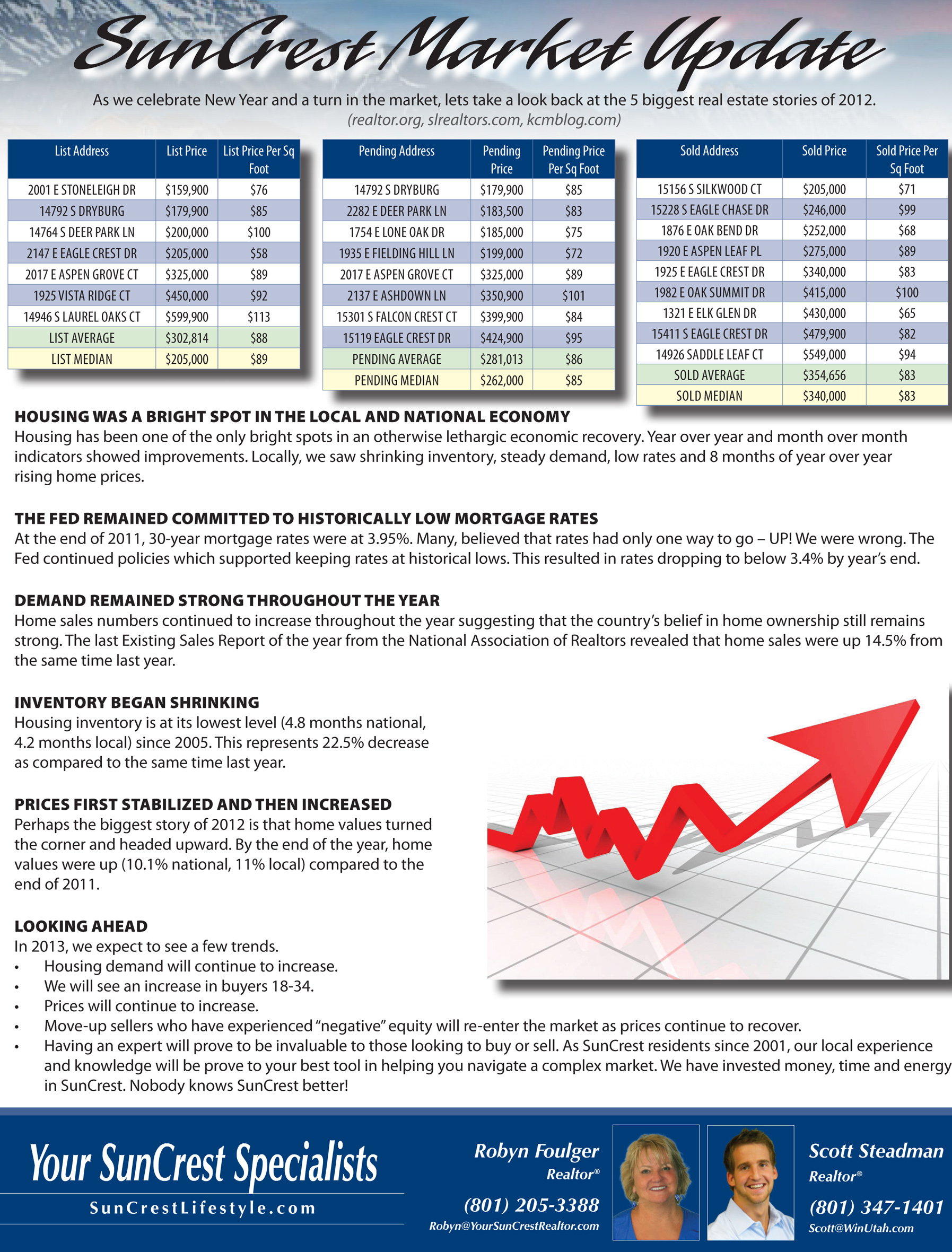

“After reaching record lows in 2012, mortgage rates are expected to creep up slowly in the year ahead, the Mortgage Bankers Association predicted.

“After reaching record lows in 2012, mortgage rates are expected to creep up slowly in the year ahead, the Mortgage Bankers Association predicted.

Rates on the 30-year fixed-rate mortgage are expected to average 3.8% in the fourth quarter of 2012, rising to 3.9% in the first quarter of 2013 and eventually rising to an average 4.4% by the fourth quarter of next year.”

If the MBA is correct, mortgage interest rates could inch up almost a full percentage point in the next year. Tomorrow, we will explain what that means to a potential buyer.

http://www.kcmblog.com/2012/11/06/where-are-mortgage-rates-headed-2/

A Step Ahead

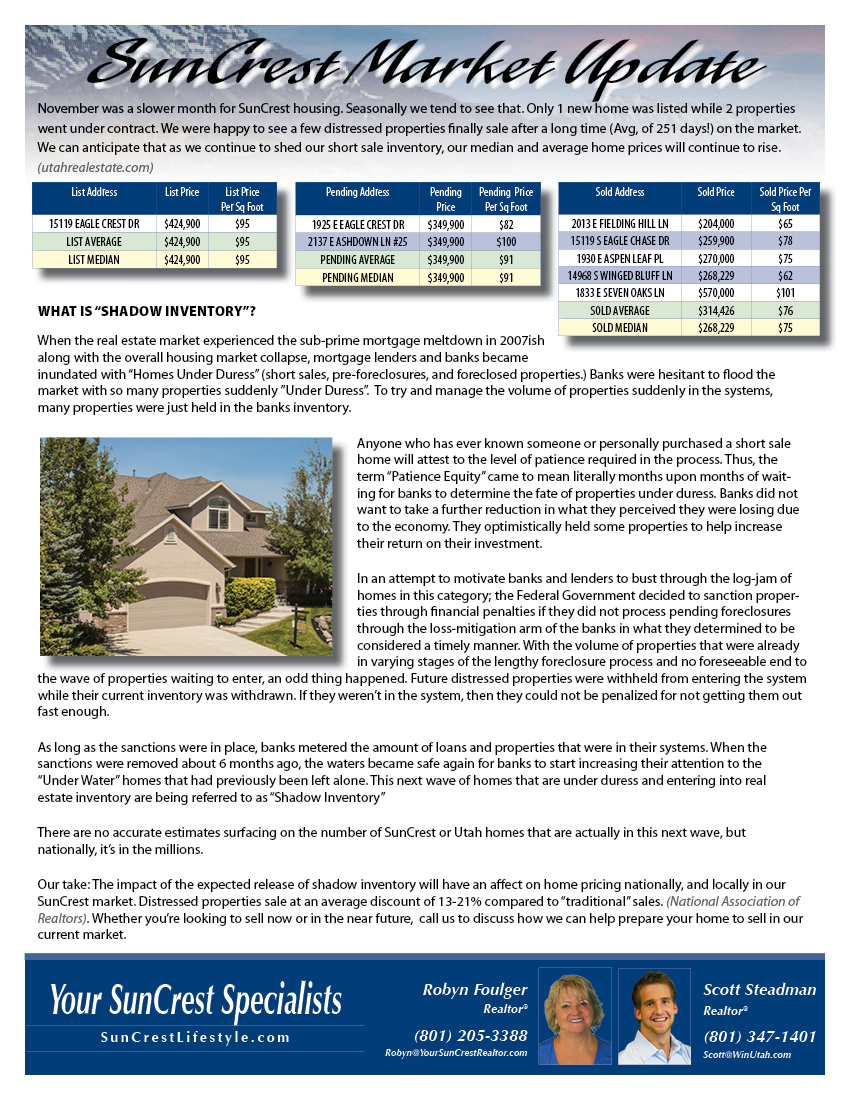

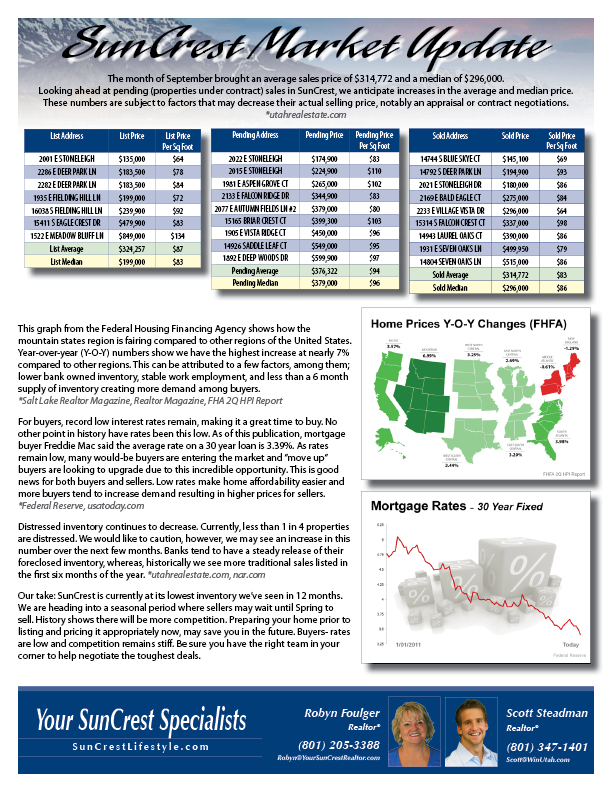

Utah is a step ahead.

Our local market continues show improvement in just about every measure.

September data shows we are on track towards recovery.

· Pending Sales: Up 22% from same period last year.

· 5 consecutive months of gains (first time since 2007 5 STRAIGHT gains!)

· Median Sales Price: Up 10% from same period last year.

· An average of 45 homes were sold per day in September.

· Number of Homes Sold: Up 21% from last year.

Nationally, the National Association of Realtors are releasing numbers that also continue to show strong signs of recovery.

· Pending Sales: Up 14.5% from same period last year.

· Existing Sales: Up 10% from last year.

· Median Sales Price: Up 11% from same period last year.

· Less than 1 in 4 properties are distressed (Foreclosure or Short Sale)

In summary, both nationally and locally, housing is strong compared to recent years. No, we aren’t back to where we were, but were headed in the right direction. Interest rates remain attractive and low levels of inventory make it a great time to sell. Ask around, talk to your co-workers, friends, and family of anyone who have recently looked for a house and they’ll tell you how competitive it is. Multiple offers and homes selling at or above list are happening daily. The ship has sailed for those “killer” deals.

My take: Having the power of knowledge will help you maximize your profit in our competitive market. Make sure you have the right player on your team to help you sell for more and buy for less.

Sources:

http://www.realtor.org/news-releases/2012/10/september-existing-home-sales-down-but-prices-continue-to-improve

http://www.realtor.org/news-releases/2012/10/september-pending-home-sales-show-slight-improvement

http://en.calameo.com/read/00161630611130b22e1c2

Facebook

Facebook

X

X

Pinterest

Pinterest

Copy Link

Copy Link