Social Links Widget

Click here to edit the Social Media Links settings. This text will not be visible on the front end.

A Step Ahead

Utah is a step ahead.

Our local market continues show improvement in just about every measure.

September data shows we are on track towards recovery.

· Pending Sales: Up 22% from same period last year.

· 5 consecutive months of gains (first time since 2007 5 STRAIGHT gains!)

· Median Sales Price: Up 10% from same period last year.

· An average of 45 homes were sold per day in September.

· Number of Homes Sold: Up 21% from last year.

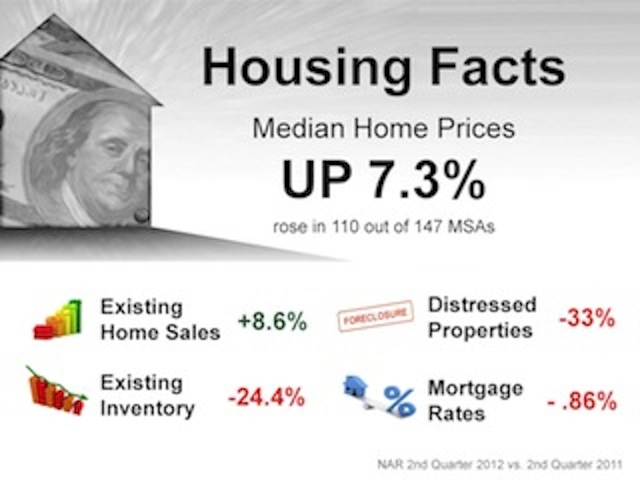

Nationally, the National Association of Realtors are releasing numbers that also continue to show strong signs of recovery.

· Pending Sales: Up 14.5% from same period last year.

· Existing Sales: Up 10% from last year.

· Median Sales Price: Up 11% from same period last year.

· Less than 1 in 4 properties are distressed (Foreclosure or Short Sale)

In summary, both nationally and locally, housing is strong compared to recent years. No, we aren’t back to where we were, but were headed in the right direction. Interest rates remain attractive and low levels of inventory make it a great time to sell. Ask around, talk to your co-workers, friends, and family of anyone who have recently looked for a house and they’ll tell you how competitive it is. Multiple offers and homes selling at or above list are happening daily. The ship has sailed for those “killer” deals.

My take: Having the power of knowledge will help you maximize your profit in our competitive market. Make sure you have the right player on your team to help you sell for more and buy for less.

Sources:

http://www.realtor.org/news-releases/2012/10/september-existing-home-sales-down-but-prices-continue-to-improve

http://www.realtor.org/news-releases/2012/10/september-pending-home-sales-show-slight-improvement

http://en.calameo.com/read/00161630611130b22e1c2

Fall Maintenance

Here are some helpful hints to get your home ready for Fall and Winter.

Stabilize the mower/other gas powered yard tools-

If your mower sits for months at a time, gas can deteriorate and damage internal engine parts. Purchase fuel stabilizer (about $10) and add to gasoline powered engines that will be hibernating for the winter.

Bring in garden hoses-

Leaving hoses attached can cause water to back up just inside the faucets. If this water freezes it can expand and cause a break or crack.

Shut down the sprinkler system-

Even buried sprinkler lines can crack. Turn off the main valve, shut off the controller, open drain valves. *If you dont have drain valves, a professional ($50-$150) can be hired to blow out the pipes with compressed air.

Seal outside-

Seal the outside of your home with caulk ($10). This is includes: between trim and siding, window and door frames, and where pipes and wires penetrate the home.

Clear your gutters-

Clear your rain gutters from debris and leaves that have gathered over the past few months. Clogged gutters can freeze and cause moisture damage.

Direct drainage-

Direct drainage away from your home. Having sloped drainage away from the home will keep the soil from soaking around the foundation.

Trim plants and bushes-

Trim plants and bushes to help keep moisture away from the home. Generally you want a 3 foot border from trees, plants and bushes. You'll also want to have at least a 1 foot border around the foundation.

Tune up the furnace-

Schedule an appointment with a local professional ($75-$100) to make sure your furnace is running properly and efficiently and free of carbon monoxide leaks. The money spent could save you hundreds and prevent a freezing cold house in the middle of Winter if it goes out. This is also a good time to clear our air ducts and change your furnace filter.

Check your fireplace –

Look inside your fireplace and make sure the damper is functioning properly. Make sure its free of debris. Check for cracking and any unusual signs of damage.

Check batteries in smoke & carbon dioxide detectors and replace as needed ($5-$10)

Change the direction of fans. This helps create an upward draft and redistributes the warm air.

September Headlines

Its hard not to notice all the headlines this month. Of 20 major metro markets evaluated, more than 3 quarters of those markets are showing increases in prices and decreases in inventory. This is having a positive influence on our housing recovery. Distressed property inventory is also decreasing, according the National Association of Realtors, now less than 1 in 4 properties are distressed (reo/short sales). As we continue to shed distressed inventory, we can continue to see signs of positive and upward trending housing recovery and prices.

Missed the headlines? No worries, here are 5 different publications from this month including our local Salt Lake publication.

September – Time to Sell?

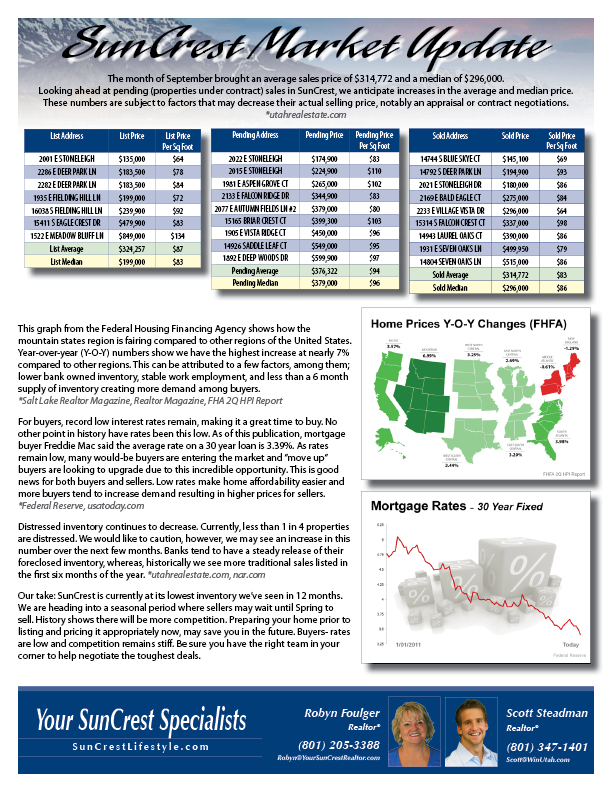

The above graph was taken from the National Association of Realtors and represents national numbers. Likewise, here in Utah, we are experiencing very similiar numbers. In second quarter of 2012, for the first time in 5 years, the median single family home price increase 6%(*slrealtor.com) year over year.

Our current inventory has continued to decrease from this same point last year. Salt Lake has maintained an under 6 month supply of housing inventory which is considered to be a "sellers market" level of inventory. This low inventory is causing an increase in prices, and in many cases, multiple offer situations for sellers.

Also worth noting is the percentage of distressed property sales in continuing to decrease. This is important because when there is less distressed properties, median prices increase.

So is now the time? The answer is, well, only you can answer that question. Some of you may be holding out to sell. You may be reading the headlines both nationally and locally that prices are rising every month and you may keep holding out. I understand the logic, but let me caution, we do have seasonal trends. Historically, we see an increase in prices in the first half of the year as opposed to the second half. We can continue to expect to see a steady release of distressed inventory (what I mean is not just a bunch at one time) that may be coming as a comparable property. Who knows how many sellers who NEED (relocation, life event, bigger home, etc) to sell within the next year may sell quickly at the first sign of decreasing prices? What we do know now is: Low inventory, low rates, qualified buyers, and increasing prices.

Facebook

Facebook

Twitter

Twitter

Pinterest

Pinterest

Copy Link

Copy Link